What is MSME?

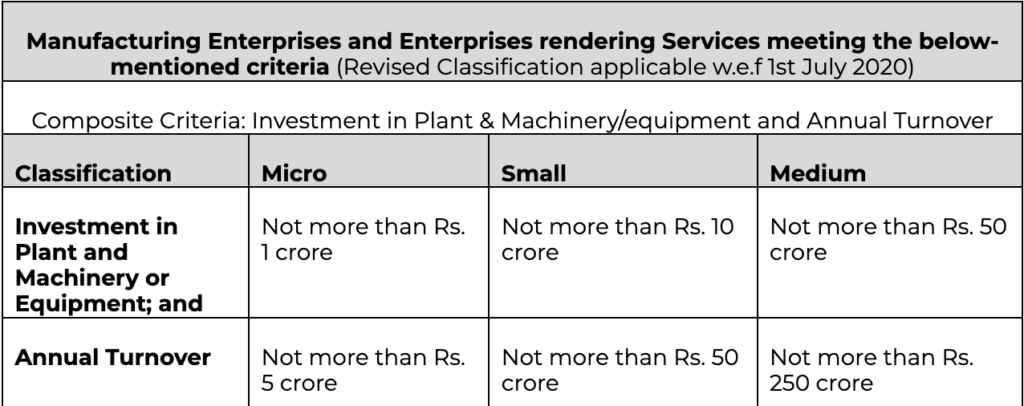

Any business enterprise meeting the below-mentioned criteria can be either classified as Micro, Small or Medium Enterprise in accordance with MSME Development Act, 2006:

Such entities can get themselves registered under the MSME Development Act, 2006 on the UDYAM portal maintained by the Government of India and get their UDYAM Registration Certificate and avail the benefits offered by the Government of India.

What are the documents required for MSME Registration?

Following documents and information is required for MSME / Udyam registration:

1. The Aadhaar number of the proprietor in the case of a proprietorship firm, of the managing partner in the case of a partnership firm and of a Karta in the case of a Hindu Undivided Family (HUF).

2. In case of a Company or a Limited Liability Partnership or a Cooperative Society or a Society or a Trust, the organization or its authorized signatory shall provide its GSTIN and PAN along with its Aadhaar number.

3. PAN of the business enterprise.

4. Address of establishment.

5. Date of incorporation (if any).

6. Date of commencement of business.

7. Previous registration number, if any.

8. Bank Account Number and IFSC Code.

9. Major business activity.

10. The number of persons employed.

11. Turnover.

12. Investment in plant and machinery/equipment.

13. Mobile Number.

14. Email Id.

What are the benefits of MSME Registration?

Following are the benefits of MSME Registration:

1.Loan without collaterals:

The Government has introduced various initiatives for MSME/SSI that allow them to avail credit without collateral. One of the best MSME registration benefits, the initiative to provide collateral-free loan is undertaken by GOI (Government of India), SIDBI (Small Industries Development Bank of India) and the Ministry of Micro, Small and Medium Enterprise under the name The Credit Guarantee Trust Fund Scheme. This is by far the best MSME registration benefit for small business owners.

2. 50% discount on patent & trademark registration:

Business enterprises registered under the MSME Development Act, 2006 are given a hefty subsidy of 50 percent discount for patent and trademark registration.

3. Overdraft facility along with interest rate exemption:

Businesses or enterprises registered as MSME/SSI under the MSME Development Act, 2006 are eligible to avail a benefit of 1% on the overdraft as part of the Credit Guarantee Trust Fund Scheme. Although this can vary from bank to bank.

4. Concession on electricity:

One of the simplest MSME registration benefits, businesses registered under the MSME Development Act, 2006 can avail a concession on electricity bills. All they have to do is submit the bills along with an application and a copy of the registered certificate (UDYAM Certificate).

5. Protection against delayed payments:

Understanding the ambiguity lying with business revenues, the Government has extended a helping hand by providing a layer of protection against payments. As of now, the Ministry of Micro, Small and Medium Enterprise has given business owners and enterprises to collect interest on payments delayed by the debtors of micro or small enterprises.

Under the MSME registration benefits, a buyer is expected to make a payment for the goods/services within 45 days. If the buyer delays, the payment for more than 45 days, the enterprise is eligible to charge compound interest which is 3 times the bank rate notified by RBI.

6. ISO certification charges reimbursement:

A registered small or medium enterprise can claim the expenses for reimbursement that were spent on ISO certification.

7. Industrial promotion subsidy eligibility:

Enterprises that are registered under MSME can also receive a subsidy for Industrial Promotion, as suggested by the Indian government.

8. Preference in government tenders:

The government of India generally gives preference to MSME registered enterprises government tenders.

9. Micro and Small Enterprise Facilitation Council (MSEFC) for settlement of disputes:

The buyer is liable to pay compound interest with the monthly rests to the supplier on the amount at the three times of the bank rate notified by RBI in case he does not make payment to the supplier for his supplies of goods or services within 45 days of the acceptance of the goods/service rendered.

If any buyer of goods or services, denies making the payment of interest or unnecessarily delays the payment of any micro or small enterprise, then the vendor can file a claim with MSEFC, which is settled within 90 days.

ABC